1. Prepare:

(a) Federation Account

(b) Consolidated Revenue Fund

From the following information:

Inflows: N’000

Import duties 1,000,000

Export duties 750,000

Excise duties 500,000

Petroleum profits tax 200,000,000

Companies income tax 177,500,000

PAYE: deductions from the emolument of the Armed Forces 1,000,000

Police personnel 75,000

Residents of Abuja 50,000

Dividend from Federal Government Investments 300,000

Outflows:

Remuneration of Statutory Officers 34,500,000

Recurrent expenditure 3,750,000

Transfer to: Development Fund 6,250,000

Contingency Fund 50,000

Note: The revenue allocation formula is:

Federal Government 52.68%

State Government 26.72%

Local Government 20.60%

2. Prepare:

(a) Federation Account

(b) Consolidated Revenue Fund

From the following information:

Inflows: N’000

Import duties 20,000

Export duties 35,000

Excise duties 50,000

Petroleum profits tax 1,600,000

Companies income tax 355,000

PAYE: deductions from the emolument of the Armed Forces 15,000

Police personnel 3,000

Residents of Abuja 2,000

Dividend from Federal Government Investments 6,000

Balance b/f 3,000

Outflows:

Remuneration of Statutory Officers 13,000

Recurrent expenditure 750,000

Transfer to: Development Fund 50,000

Contingency Fund 10,000

Note: The revenue allocation formula is:

Federal Government 52.68%

State Government 26.72%

Local Government 20.60%

3. (a) Enumerate nine key factors which militate against efficient and effective budget

implementation in the public sector

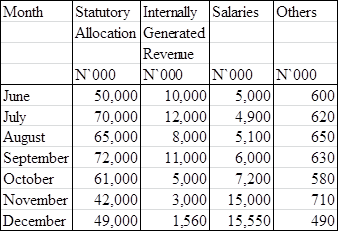

(b) Mawibekiri State Government has a problem of not being able to pay the salaries of workers promptly.

Apart from the statutory allocations receivable from the State and Federal Governments, internally generated sources are meagre.

You are the Chief Accountant assigned the responsibility of managing the Treasury.

The following information are available:

On 31 May, 2020, the State anticipated the under listed transactions up to 31 December, 2020:

(i) Prepare the Cash Budget of the State for June to November, 2020.

(ii) Advise the Government on the ways of optimizing the use of liquid funds.

4. (a) What do you understand by Public Sector Accounting and state five of its features.

(b)Banuso State Government has a problem of not being able to pay the salaries of

workers promptly. Apart from the statutory allocation receivable from the State and

Federal Governments, internally generated sources are meagre.

You are the Chief Accountant assigned the responsibility of managing the Treasury.

The following informations are available:

On 31st May, 2020 the state anticipated the under listed transactions up to

31st December, 2020.

(i) Prepare the cash budget of the State for June 2020 to November 2020.

(ii) Advise the Government on the ways of optimising the use of liquid funds.

5. (a) Explain the powers of the:

i. Accountant-General of the Federation

ii. Audit-General for the Federation

(b) In accordance with Government Financial Regulations, define Accounting Officers and state five of his or her functions.

6. (a) Define Consolidated Revenue Fund

(b)How many revenue heads are payable into the Consolidated Fund Account, and which

line of expenditures is it used to finance.

7. (a) Write short note on:

i. Trust Fund ii. Special Fund

iii. Contingency Fund iv. Capital Project Fund

v. Self-Liquidating Fund vi. General Fund

(b) What are the main roles of National Assembly in planning and monitoring of public

expenditure.

8. (a) There are three bases under which the financial statements of a public sector enterprises are compiled. These are:

i. The cash basis

ii. The accrual basis

iii. The commitment basis

As a student of Management and Business Studies, explain each of the bases and give two each merits and demerits.

(b) Write short note on:

i. Financial Regulations ii. Treasury Circulars iii. Audit Ordinance of 1956

iv. Nigerian Constitution v. Fiscal Responsibility Act of 2007

9. (a) Enumerate nine key factors which militate against efficient and effective budget implementation in the

public sector

(b) Discuss the main objectives of government economic policies in a developing economy like

Nigeria.

10. COME TO CLASS FOR IT!

Instructions: To be submitted 10a.m prompt on or before Thursday October 21, 2021

✍️🕋🇳🇬 Patriot Odunaro Babatunde Jimoh💙💚🖤💜

No comments:

Post a Comment